[ad_1]

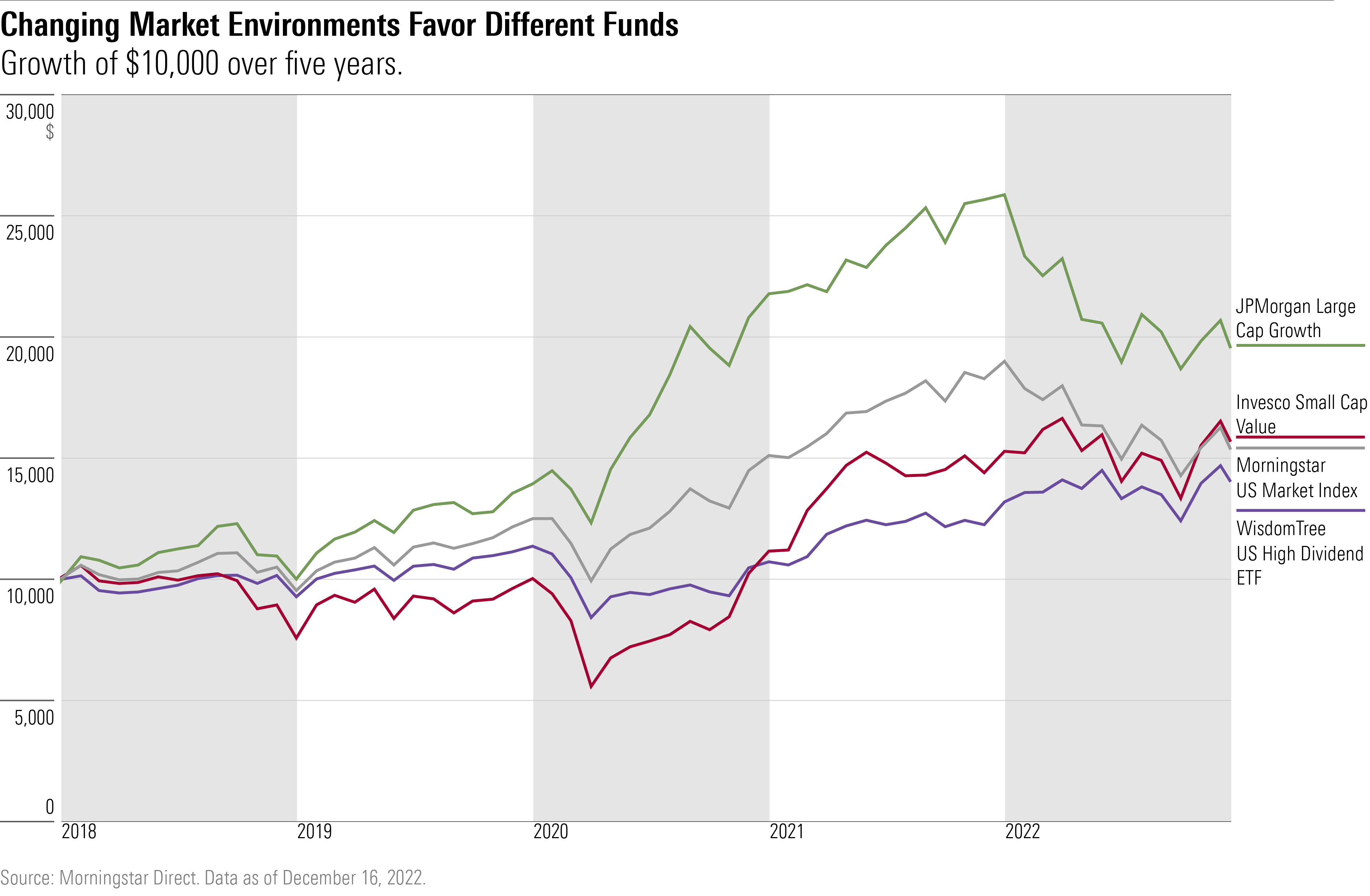

Entering this year, US stock funds posting single-digit gains were disappointing for most investors. Many mutual funds will post annual gains of 20% or more in 2019, 2020 and 2021.

When it comes to 2022 returns, however, any stock fund in positive territory has performed significantly. As the overall stock market fell more than 20% in the morning, only five of the 548 funds covered by analysts posted positive results, weighing in on the cheapest class of stocks since Dec. 19.

What do the best performing funds of 2022 have in common?

The backdrop for stocks was that rising inflation, rising interest rates and fears of a recession had sent much of the market into negative territory. The Energy and Utilities sectors were the only two to show positive returns, while the Communication Services and Technology sectors were the worst performers. These trends have tended to benefit value funds, including diversified funds, and have given funds focused on fast-growing stocks a real headwind.

Pulling back the lens and looking at 3- and 5-year returns for top performers gives a different picture. Thanks to big gains in previous years, some growth funds have managed to occupy top positions on the platform.

For this article, we’ve compiled a list of mutual funds covered by Morningstar analysts that have bronze, silver or gold status. We ranked each fund’s performance using the lowest-cost share class.

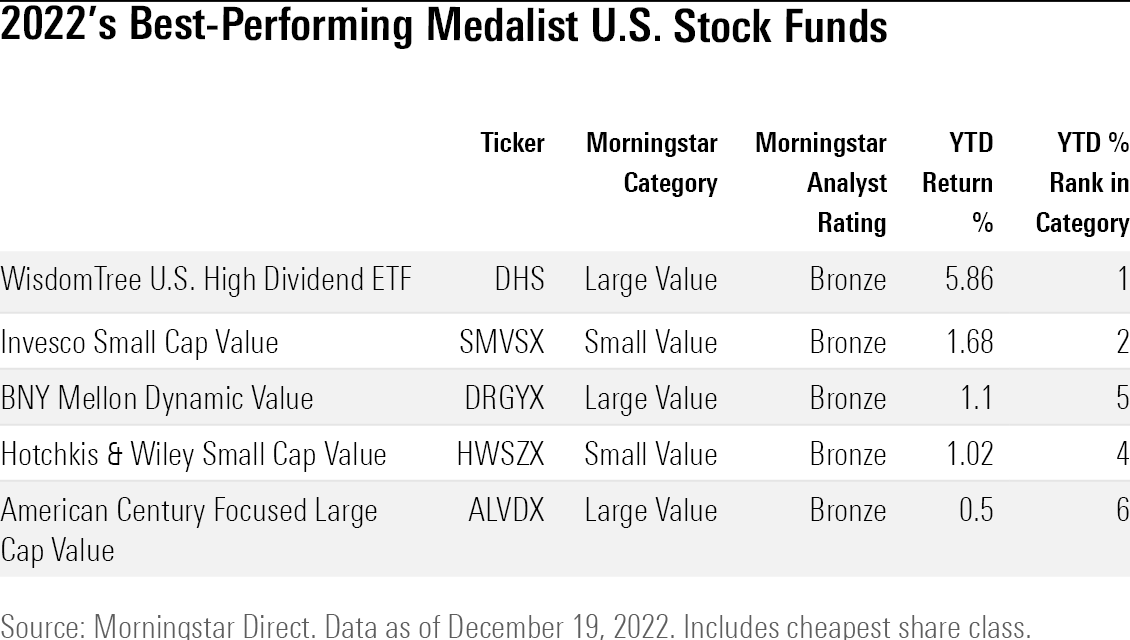

Best performing stock funds of 2022

A few value funds lead all the Morning Star Medals this year.

WisdomTree US High Dividend ETF (DHS) landed at the top of the rankings. The $1.4 billion fund is up 5.9 percent for the year. “Energy stocks are the tail end of the portfolio,” said Morningstar associate managing research analyst Zachary Evans. “For the year to November 30, the fund’s energy share averaged 19.4%, compared to the benchmark’s share of 7.5%,” he says. ExxonMobil (XOM), up 77.7% this year, and Chevron (CVX), up 50%, contributed to the fund’s success.

“Getting rid of toxic technology stocks has also helped performance,” he says.

BNY Mellon Dynamic Value ( DRGYX ) helped avoid hard-hit communications services stocks. As of June 2022, Alphabet ( GOOGL ), the parent company of Google, held the fund’s sole holding of communications services, wrote Morningstar managing research analyst Drew Carter. Instead, the portfolio was overweight the financials and healthcare sectors as of June 2022. The $2.4 billion fund rose 1.1%, while the average large-cap fund fell 7.3%.

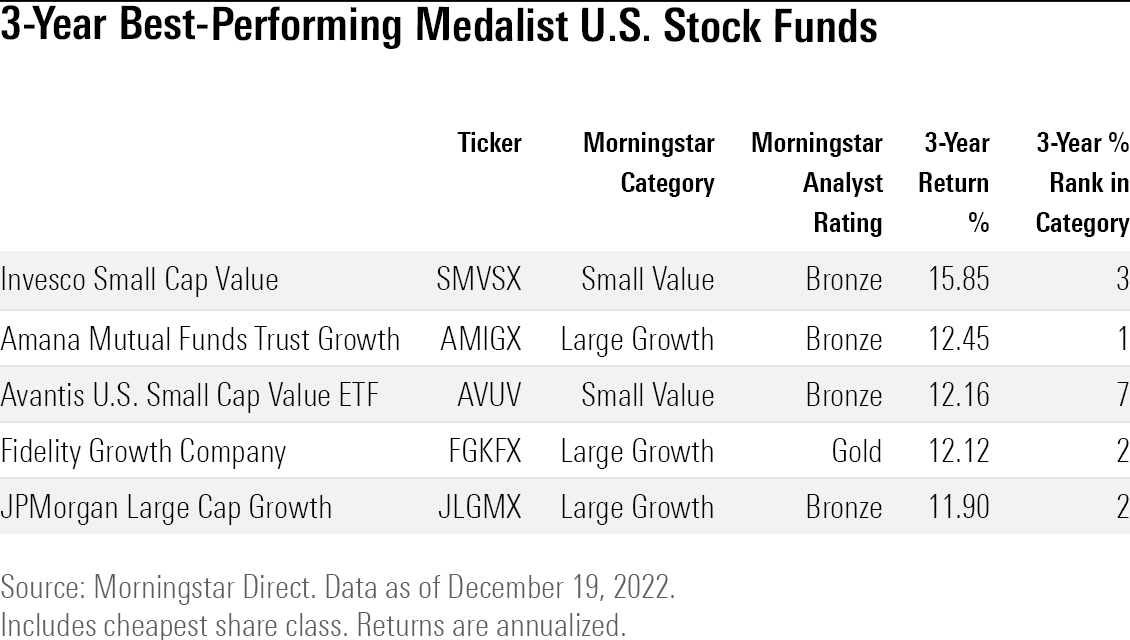

3-year best performing stock funds

Although the year While value strategies have performed relatively well in 2022, the picture has been more mixed between value and growth strategies over the past three years. Invesco Small Cap Value ( SMVSX ) has returned the most of any mutual fund, with the $2.4 billion fund gaining 15.9% annualized over the past three years. This year, a nearly 10 percent overweight to the energy sector has helped the fund, said Morningstar analyst Andrew Redden. “In the past three years, overweight allocations to industrials and energies and underweights to technology and financial services helped the results,” he said.

The $11.6 billion Fidelity Growth Company ( FGK .The $11.6 billion Fidelity Growth Company is behind. In the year Despite a 32.1% loss in 2022, the fund is up 12.1% annually over the past three years. “The fund’s underperformance (in 2022), while disappointing, is in line with what you would expect from the strategy, given the strategy,” said Morningstar strategist Robbie Greengold. With a 68.7% gain in 2020, the fund’s previous strong performance helped save losses for long-term investors. “Typically concerned with the market’s daily gains and losses, the fund outperforms on the upside.”Greengold writes.

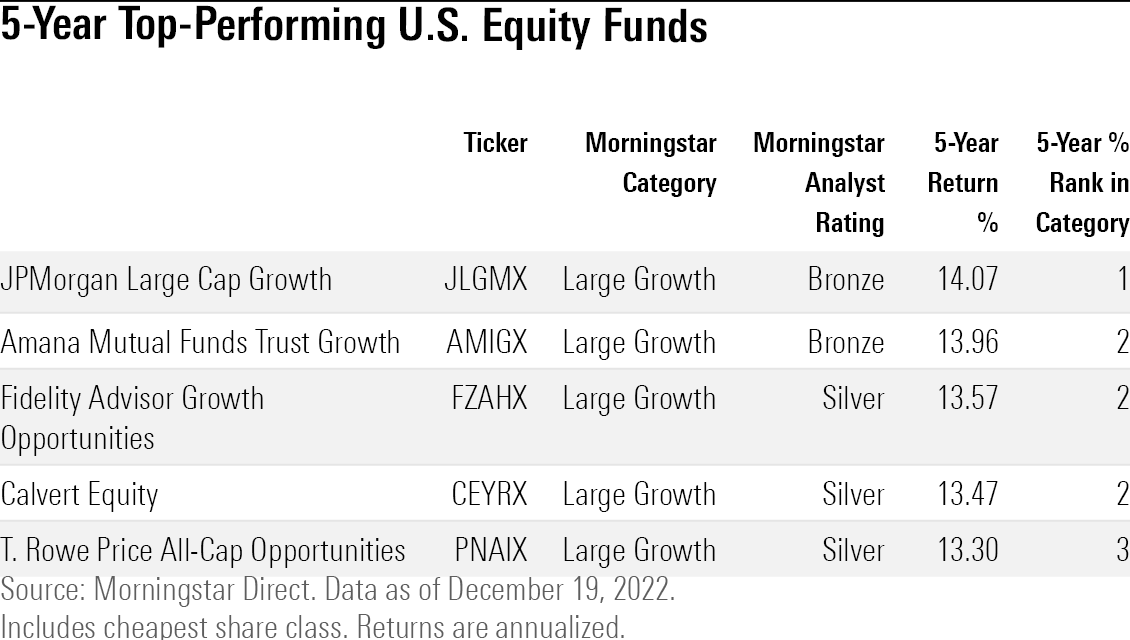

5-year best performing stock funds

When it comes to 5-year track records, the long-term dominance of growth funds becomes even more evident. The $36.8 billion JPMorgan Large Cap Growth ( JLGMX ) has returned an annualized 14.1% over the past five years. The strategy followed the marketA big first-quarter 2020 decline, with institutional stocks gaining a whopping 100.6% versus the benchmark’s 81.5%, thanks to stock picks like Tesla ( TSLA ). The fund is down 22% this year, better than the average large growth fund.

Lately, the managers have downplayed their technology stake. “Managers have already rolled back stakes in Tesla and NVDA in early 2021, as well as holdings in META Platforms in early 2022 in the year before the fall,” the latest financial report says.

T. Rowe Price All-Cap Opportunities (PNAIX) also made similar moves. The fund is up 13.3 percent annually over the past five years and is down just 21.9 percent in 2022, while the average large growth fund is down 30 percent. “In 2021, managers have done well,” writes Morningstar senior managing research analyst Adam Saban. “High valuations, signs of market excess and signs that the Federal Reserve is taking inflation seriously have led managers to divest from many strong-performing growth stocks, whose market value is largely based on expected future earnings. On Growth Stocks 2022 Before losing, he avoided huge losses by selling companies like Shopify ( SHOP ), StoneCo ( STNE ), DocuSign ( DOCU ) and Wix.com ( WIX ).

[ad_2]

Source link