[ad_1]

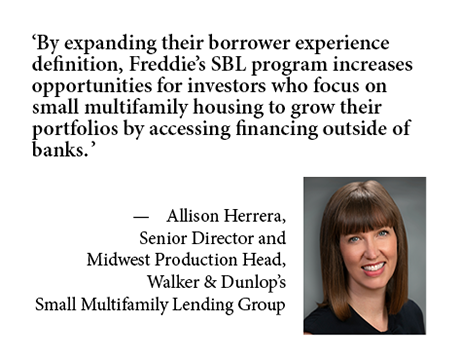

By Alison Herrera, Walker & Dunlop

Beginning Dec. 15, Freddie Mac will begin accepting ownership of two to four units — duplexes, triplexes or quadplexes — as qualifying experience for all loans in its Optigo® Small Balance Loans (SBL) program. Previously, Freddie Mac defined a multifamily experience as controlling a property with at least five or more units and excluded two to four units.

By expanding the definition of borrower experience, Freddie’s SBL program increases opportunities for investors focused on small multifamily housing to grow their portfolios by accessing financing outside of banks.

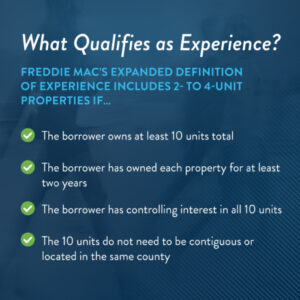

What qualifies as experience?

Here’s what you need to know. Freddie Mac has expanded the definition of multifamily experience to include borrowers with a two- to four-unit property portfolio that meets the following criteria:

- Borrower must own at least 10 units

- Borrowers must own each property for at least two years

- The borrower must have a controlling interest in all 10 units

- The 10 units must not be contiguous or located in the same country

The new requirements provide investors with access to agency debt when starting to invest in larger properties, such as 5 to 50 units, rather than continuing to rely on the bank. No-back financing provided by Freddie Mac allows borrowers to pledge property only as collateral, unlike banks that routinely require personal assets other than property as collateral. This allows borrowers to expand their portfolio more quickly because they have no contingent liabilities on the balance sheet and free up access to capital.

Freddie SBL is expanding financing for two- to four-unit properties under its Link Loans program

Freddie Mac has financed duplex, triplex and quadruplex properties in the past under its Link Loans program. However, under the old rules, all units had to be contiguous. A number of investors buy properties next to each other and they unfortunately have not been able to take advantage of Link Loans.

In addition, Freddie Mac is opening the Link Loans program in all of its designated market tiers – top, standard, small and very small. (This is roughly analogous to the traditional primary, secondary, and tertiary market levels of commercial real estate.)

With these additional tweaks to their programs, Freddie Mac now accepts the package undirected Features – at least 10 units if the following conditions are met:

- The minimum loan amount is 2 million dollars

- Buildings located within 3 miles of any other building included in the loan (exceptions may be made up to 5 miles)

- The buildings are in the same district

- Not an owner-occupied unit

- Unauthorized one-room buildings are not allowed

- All properties must use shared property management and provide shared financial resources after closing

If you want to take advantage of these changes, Walker & Dunlop can help. We will determine if your property meets the requirements. And if you’re interested in the Link Loans program, we have experience and expertise in financing portfolios for small multifamily assets. We want to be your partner to help you grow your portfolio and maximize your returns over the life cycle of your investment. Let us show you how.

– Alison Herrera is a senior director and head of Midwest production for Walker & Dunlop’s small multifamily lending group. Walker & Dunlop is a content partner of REBusinessOnline. For more articles and news about Walker & Dunlop, click here.

[ad_2]

Source link