[ad_1]

courtneyk | E+ | Getty Images

After a rough year for the stock market, investors can’t expect to receive a surprise tax refund from year-end actively managed mutual fund payouts, experts say.

When the fund manager sells the assets at a profit to offset losses, those profits are passed on to investors. Profits are taxable to investors when they are received in a brokerage account.

Related investment news

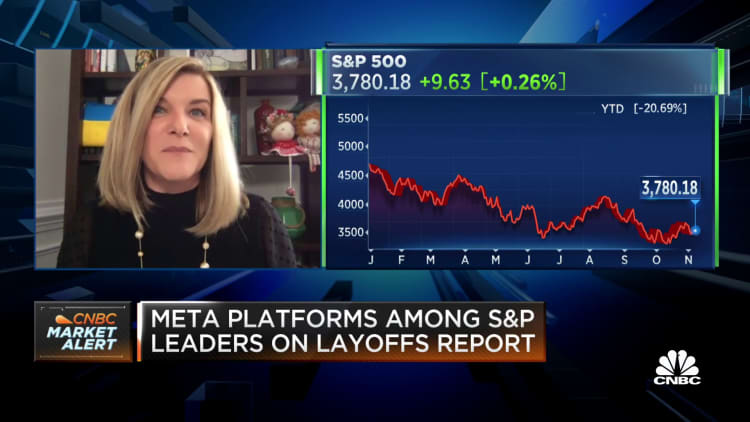

While S&P 500 It’s down more than 20% for 2022, with many funds starting the year with already contained gains, according to Morningstar. And some fund managers sold profitable assets as funds continued to shift from active to managed funds.

As a result, some investors may see year-end mutual fund distributions despite stock market losses in 2022, the report notes.

More from Personal Finance:

How to use pay transparency to negotiate a better salary

6 Health Insurance Terms You Should Know When Open Enrollment Begins

What the Fed’s fourth rate hike of 0.75 percentage points means for you.

“It’s a double whammy,” says Tommy Lucas, a registered financial planner and registered agent at Moisand Fitzgerald Tamayo in Orlando, Florida.

While you owe long-term capital gains tax of 0%, 15% or 20% on assets held for more than a year, you may pay regular income tax on investments held for less than a year.

Lucas says mutual fund fees often “slip under the radar” and should be included as part of an investor’s year-end tax plan.

When to expect year-end mutual fund payments

Typically, mutual fund payouts are made once a year, in mid-December, after funds report estimates in late October or early November, explained Stephen Welch, a research analyst at Morningstar.

After receiving a mutual fund estimate, you have until the “registration date” or the deadline for payment to make ownership changes.

Morningstar’s report covers current distribution estimates for some of the largest funds, with further updates coming in mid-November.

Consider tax loss harvesting to reduce capital gains

Many investors are not expecting year-end mutual fund distributions in 2021, said Jim Guarino, CFP, CPA and managing director at Baker Newman Noyce in Woburn, Massachusetts.

“I know a lot of my clients were absolutely killed,” he said.

But this year’s market downturn may offer a silver lining — an opportunity to offset gains from losses, known as “tax-loss harvesting” — to know your full tax situation and take action by the end of the year, Guarino said.

If you start receiving tax forms from brokers in January or February, it’s too late to reduce your capital gains tax for 2022, he said.

[ad_2]

Source link