[ad_1]

Two months into his chaotic reign, early indications are that those concerns were justified.

Move fast and break things

Last week, Twitter announced new rules under which it will suspend accounts that link to other social media platforms such as Facebook and Instagram with the primary purpose of promoting content on these platforms. It also said that tweets promoting accounts on those platforms could be removed if users invited their Twitter followers to join them there.

The move sparked an immediate backlash from Twitter users, some of whom pointed out that the new rules are illegal under US antitrust law and the European Union’s Digital Markets Act.

Twitter quickly deleted the tweets and website announcing the new policy and Musk tweeted a few hours later: “There will be votes for major policy changes in the future. My apologies. Will not be repeated.”

He then tweeted a poll asking Twitter users whether he should step down as head of the company, adding: “I will abide by the results of this poll.

Of course, almost 60% of the 17 million Twitter users who took part in the poll voted ‘yes’.

It’s hard to imagine that Musk expected anything but this result when he tweeted the poll.

When asked later if he would in fact step down, he replied: “I will resign as CEO as soon as I find someone foolish enough to take over the job!” After that, I’ll just be leading the software and server teams.”

This management style has become typical of Musk’s approach to running Twitter and has raised concerns about his other ventures.

Turmoil at Tesla

On Wednesday, the news site Electrek reported, citing a source, that there will be another wave of layoffs at Tesla next quarter and that the electric vehicle maker will also freeze hiring. Musk said in June that the company would cut its workforce by roughly 10 percent over the next three months.

In October, the company said it would miss its 2022 delivery targets due to slowing growth and supply chain disruptions.

And starting this week, Tesla is offering a rare year-end discount of $7,500 to U.S. buyers on the Model 3 and Model I as it looks to spur demand. These, by the way, are his cheapest models and make up the majority of orders.

Tesla analysts also cut their price targets for the stock, worried that weak demand from China will affect deliveries next year.

The company’s stock has already been rocked in 2022, down 60% and on track for its worst year ever. Since they make up the lion’s share of their CEO’s net worth, Musk is no longer the richest person in the world as of this week.

There are more than enough reasons for Musk to turn his focus back on Tesla and the growing concerns of its shareholders, and his latest Twitter poll suggests he agrees. The only question is, how quickly can he find someone foolish enough to be the next top Tweet?

Written by Zaheer Merchant in Mumbai

Top stories from our journalists

Flipkart-PhonePe demerger

PhonePe spins off from Flipkart: Flipkart, which acquired online payment platform PhonePe in 2016, has officially spun off its operations from the company. The layoff also completes a move begun earlier this year to make PhonePe a fully India-based company. US retailer Walmart, which bought a 77% stake in Flipkart in 2018, will remain the majority owner in both entities.

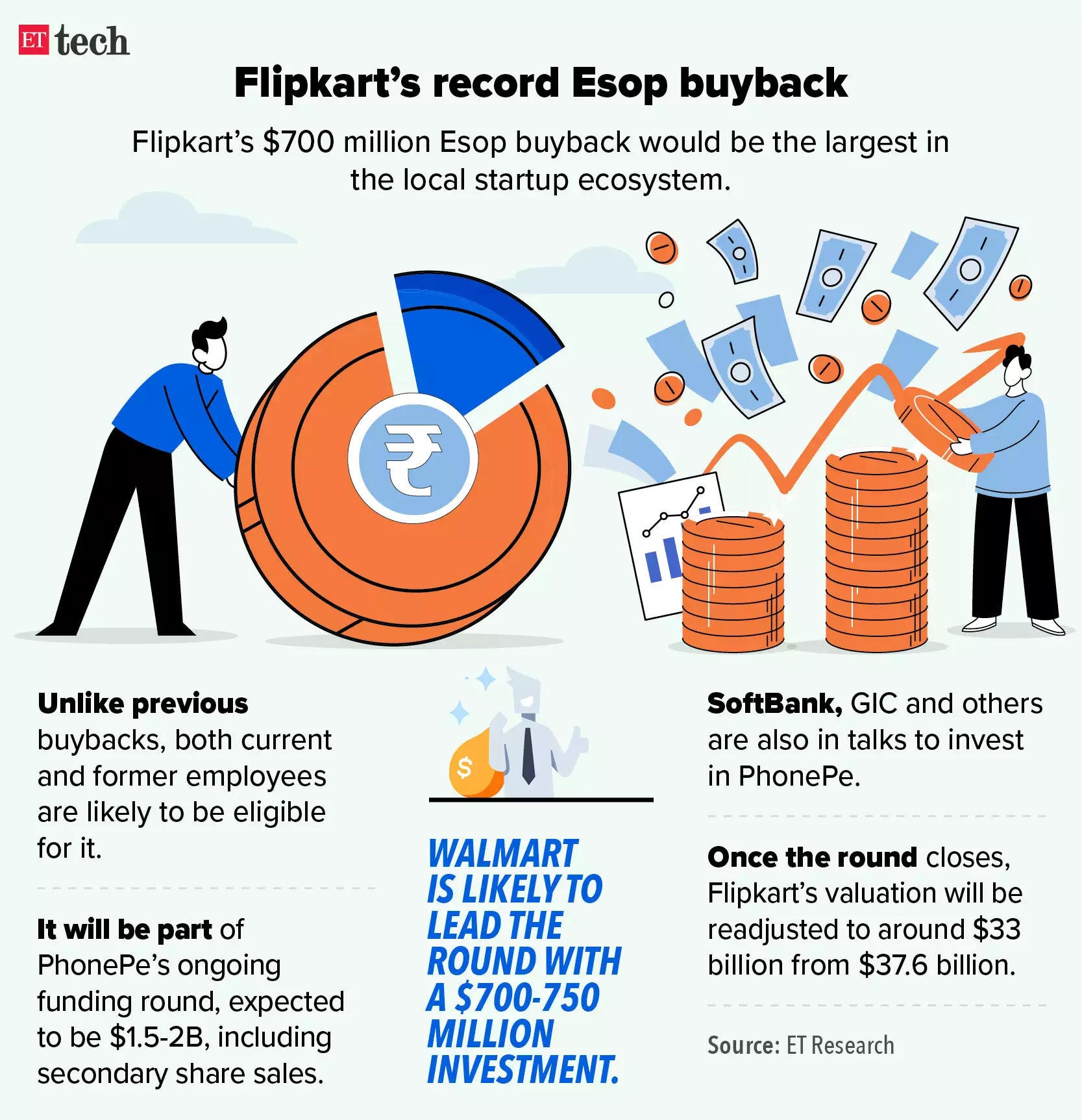

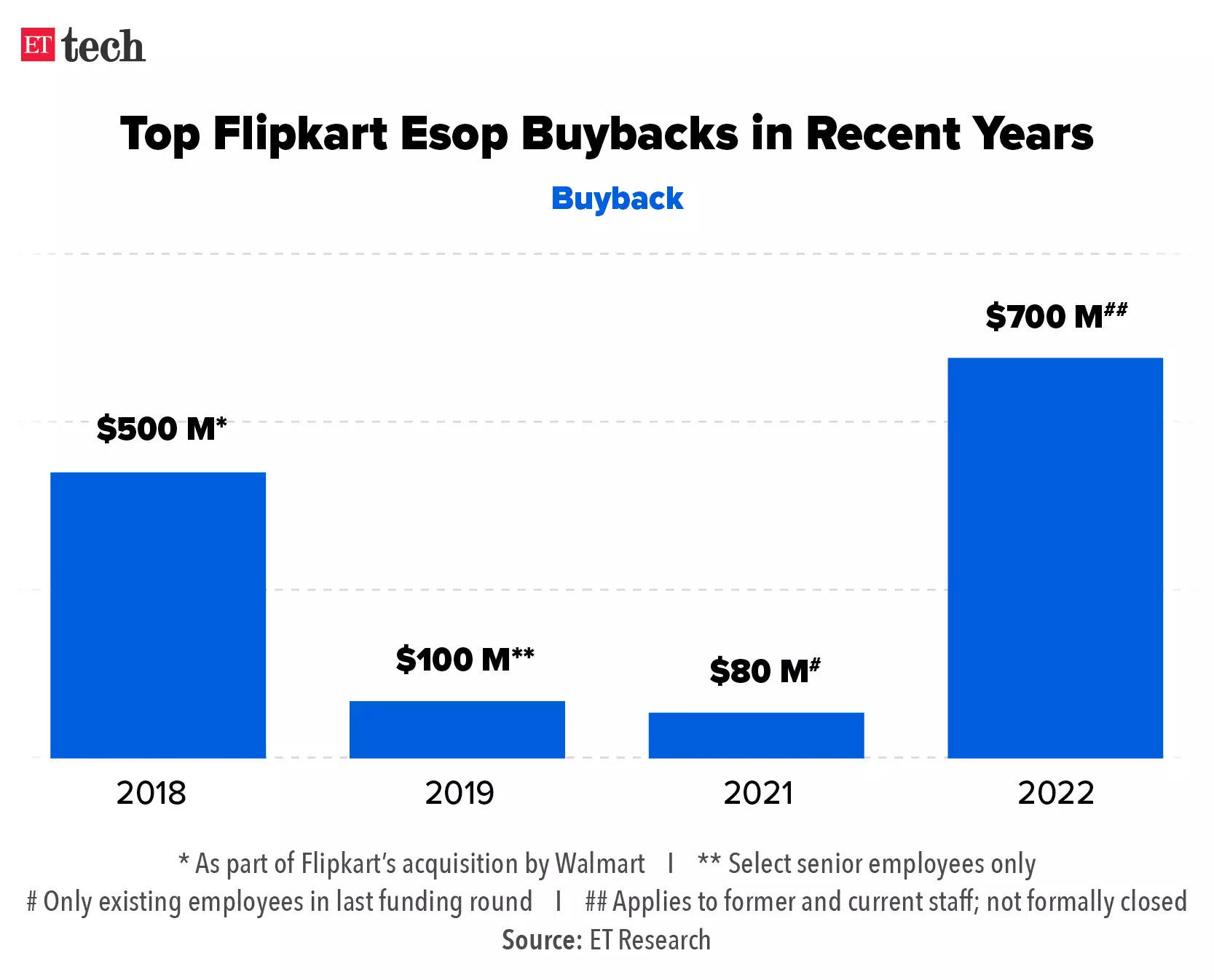

Almost $700 million in cash payouts for Flipkart employees: After the PhonePe rollout, Flipkart Group CEO Kalian Krishnamurthi sent an email to his employees informing them of a one-time payment as part of the transaction.

“This payout represents the value of PhonePe holdings under those Flipkart options… [It] will present a wealth creation event for our employees,” Krishnamurthy wrote. ET first reported that Flipkart was planning a $700 million employee share buyback (ESOP), which would be the largest share buyback in the Indian startup ecosystem.

M&A, deals and fundraising

BigBasket raises $200 million from Tata Digital, others: BigBasket has raised $200 million in fresh funding that boosts the Tata Digital-owned e-tailer’s valuation to $3.2 billion, a top executive told us. Besides Tata Digital, which owns 64% in the Bengaluru-based company, other investors in the firm also participated in the funding round.

Mensa Brands acquires MensXP and iDiva: E-commerce brand aggregator Mensa Brands, in partnership with India Lifestyle Network, has acquired online lifestyle publications MensXP, iDiva and influencer marketing management firm Hipp from Times Internet. After the deal, all three platforms will continue to operate as independent brands and destinations in their respective segments.

Tatas pump Rs 1,600 crore into Tata Clik: The Tata Group has invested Rs 1,600 crore in its omni-commerce entity Tata UniStore, which owns and operates the Tata Clik platform, according to regulatory filings. With this, the group has invested over 5,000 million dinars in the e-commerce business this fiscal period.

Technical Policy Updates

Google appealed the CCI verdict on Android in the NCLAT: Google has appealed the Competition Commission of India (CCI) order regarding unfair business practices in the Android mobile ecosystem in the National Company Law Appellate Tribunal (NCLAT). The appeal comes days after CEO Sundar Pichai, who was in India earlier this week for the Google For India event, spoke about the need for “responsible regulation” and said India could take the lead in this area.

House panel deems Big Tech’s advertising business a ‘monopoly threat’: A parliamentary committee called Big Tech’s advertising business a “monopolistic threat” and asked the government to act early and prevent anti-competitive behavior in digital markets. Noting that leaders tend to emerge quickly in digital markets, the Standing Committee on Finance said: “Competitor behavior should be evaluated ex ante before markets are monopolized rather than an immediate ex post evaluation,” proposing a framework for systemically important digital intermediaries (SIT).

Karnataka policy targets 10,000 new startups in five years: The Karnataka Cabinet on Thursday approved a new startup policy that aims to add around 10,000 more startups over the next five years. According to Karnataka IT/BT Minister CN Ashvath Narayan, the broad objective is to help grow around 25,000 startups over five years with a special focus on multiplying the number of high-growth ones.

IT Ministry extends deadline for public feedback on data bill to January 2: Last Saturday, MeitI extended the last date for public consultation on the draft Digital Personal Data Protection Bill (DPDPB), 2022, to January 2, 2023. The ministry said it was extending the timeframe “in response to requests received from several stakeholders”. The draft was first published on November 18.

ETtech interviews

India can be a “shining example,” says Pichai: In an exclusive interview, Sundar Pichai, CEO of Alphabet and Google, told us that innovations like UPI, Aadhaar and India Stack combined with responsible regulation can make India a “shining example” to the world. He also expressed concern over two rulings by India’s competition watchdog against Google in October, saying they could threaten user privacy and security.

Google’s Sanjay Gupta on growth, revenue and more in India: Google’s advertising revenue in India is likely to continue to see strong growth, country head Sanjay Gupta told us. “I think India is going to explode in terms of revenue because the ratio of ads to GDP (gross domestic product) in India is still very low. It is 0.4 percent,” Gupta added.

TCS’ Rajesh Gopinathan Outlook for 2023: Tata Consultancy Services (TCS) is on track to double its revenues to $50 billion by 2030, its CEO and MD Rajesh Gopinathan said. The company, however, anticipates the impact of a combination of tightening interest rates by the US Federal Reserve and an unstable geopolitical scenario in 2023.

In an exclusive interview, he said the long-term growth story, however, is intact and 2023 will be a balanced year after two years of very strong growth.

IT corner

IT firm clients are focusing on smaller businesses amid a cautious environment: Clients of IT services companies are focusing on smaller businesses due to the cautious macroeconomic environment in large geographies such as the US and Europe. The share of large awards above the $100 million (800 crore) annual contract value (ACV) range hit a five-year low, accounting for just 10% of deal activity in the July-September quarter, the ISG report said.

IT companies expect operating margins to jump as waste declines: The operating margin of Indian IT professionals is expected to improve as outflows register a significant decline as the demand cycle is expected to moderate and layoffs across the industry have cooled the ‘job market’. According to experts, attrition, or the number of employees leaving in the last 12 months, has fallen in the range of 17-18% in the technology industry.

Review of 2022

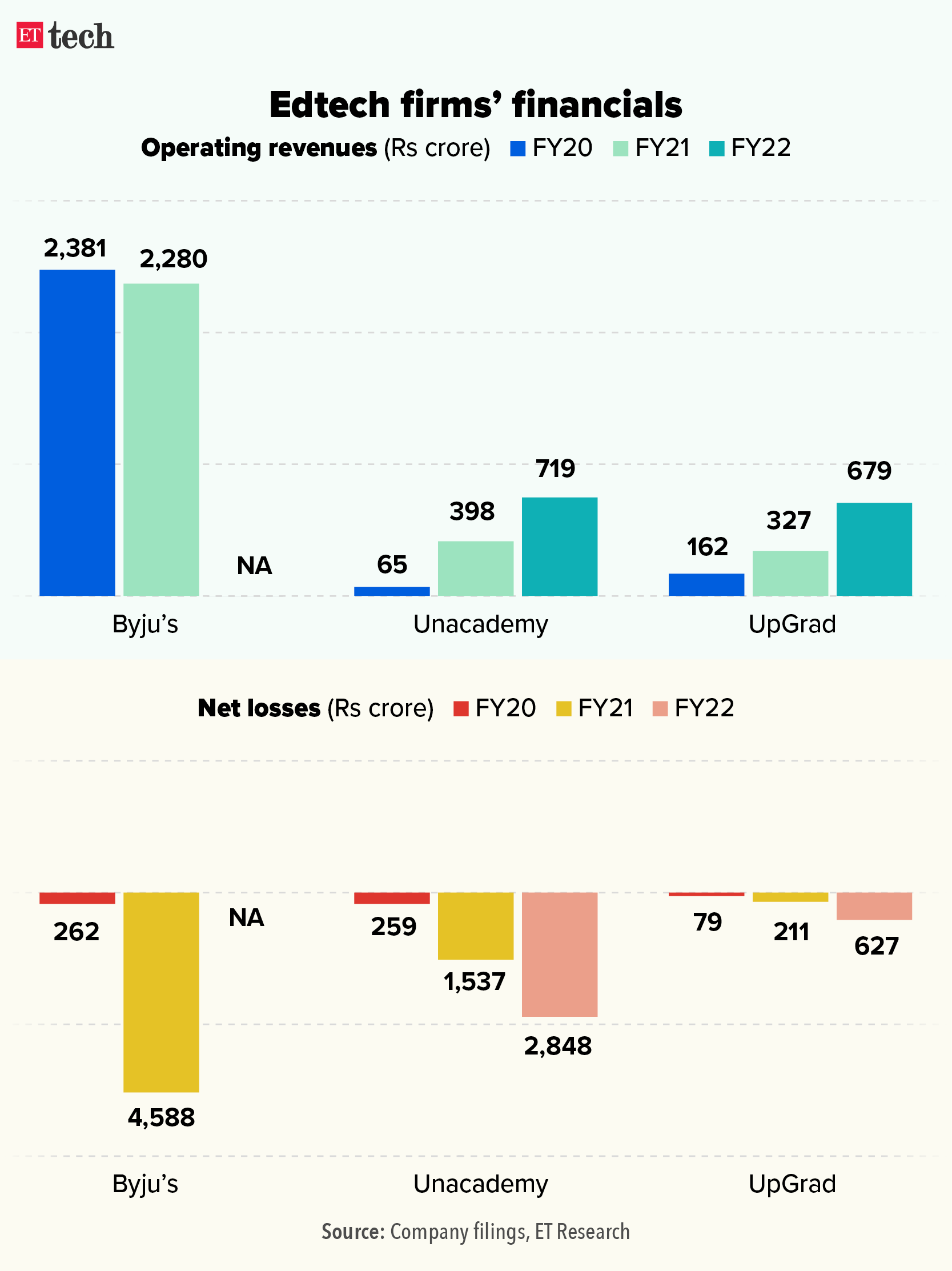

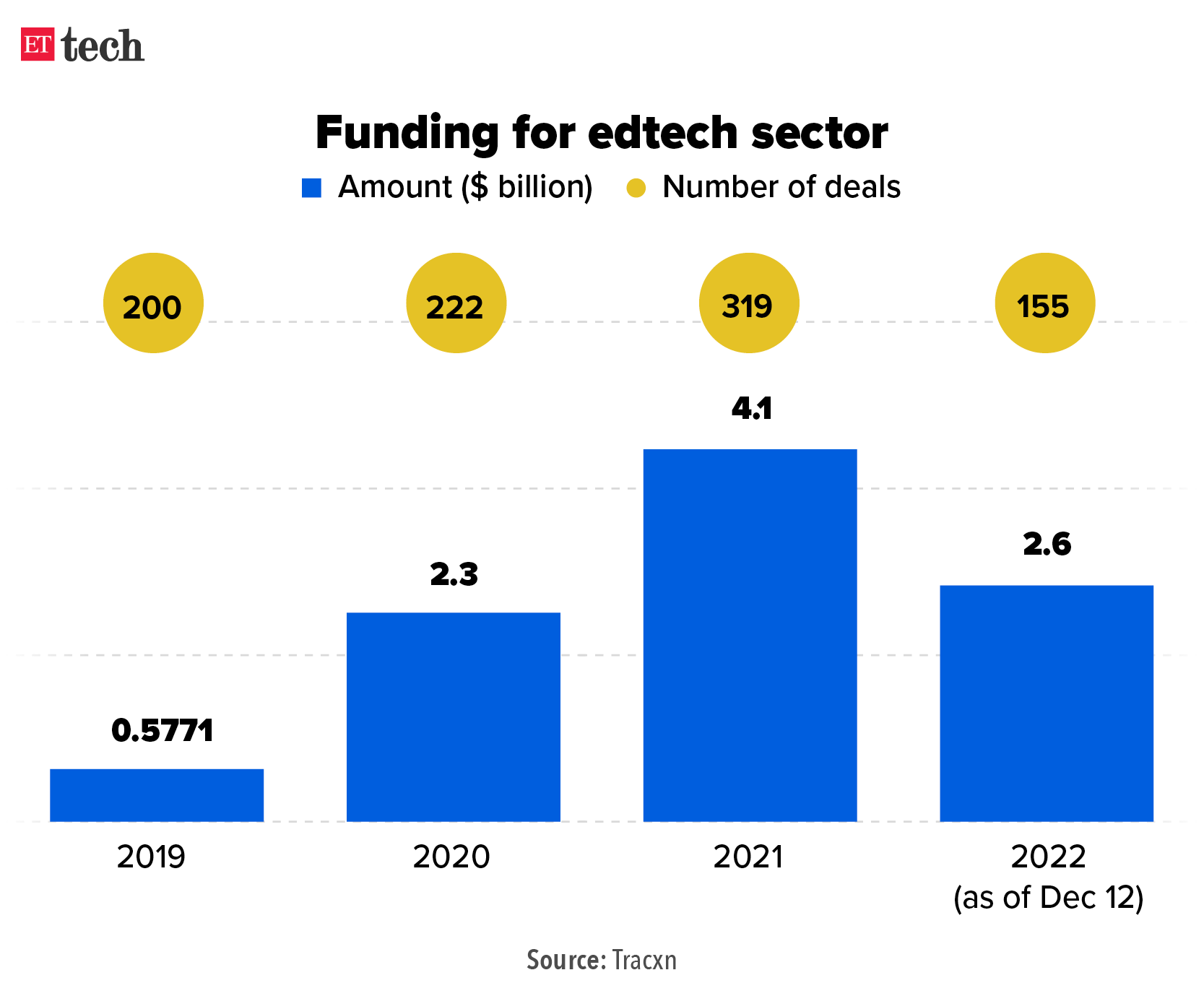

As the pandemic bubble bursts, edtechs return to the classroom: The boom caused by the pandemic is over and the tech funding has stopped. And this has forced edtech ventures to further reduce costs and seek sustainable offline models with revenue streams that generate profits, entrepreneurs and investors say.

Edtechs are expected to move away from the K-12 business model in the coming year and focus on priorities such as greater offline play, tapping international markets with higher disposable income, and digitizing the existing school system.

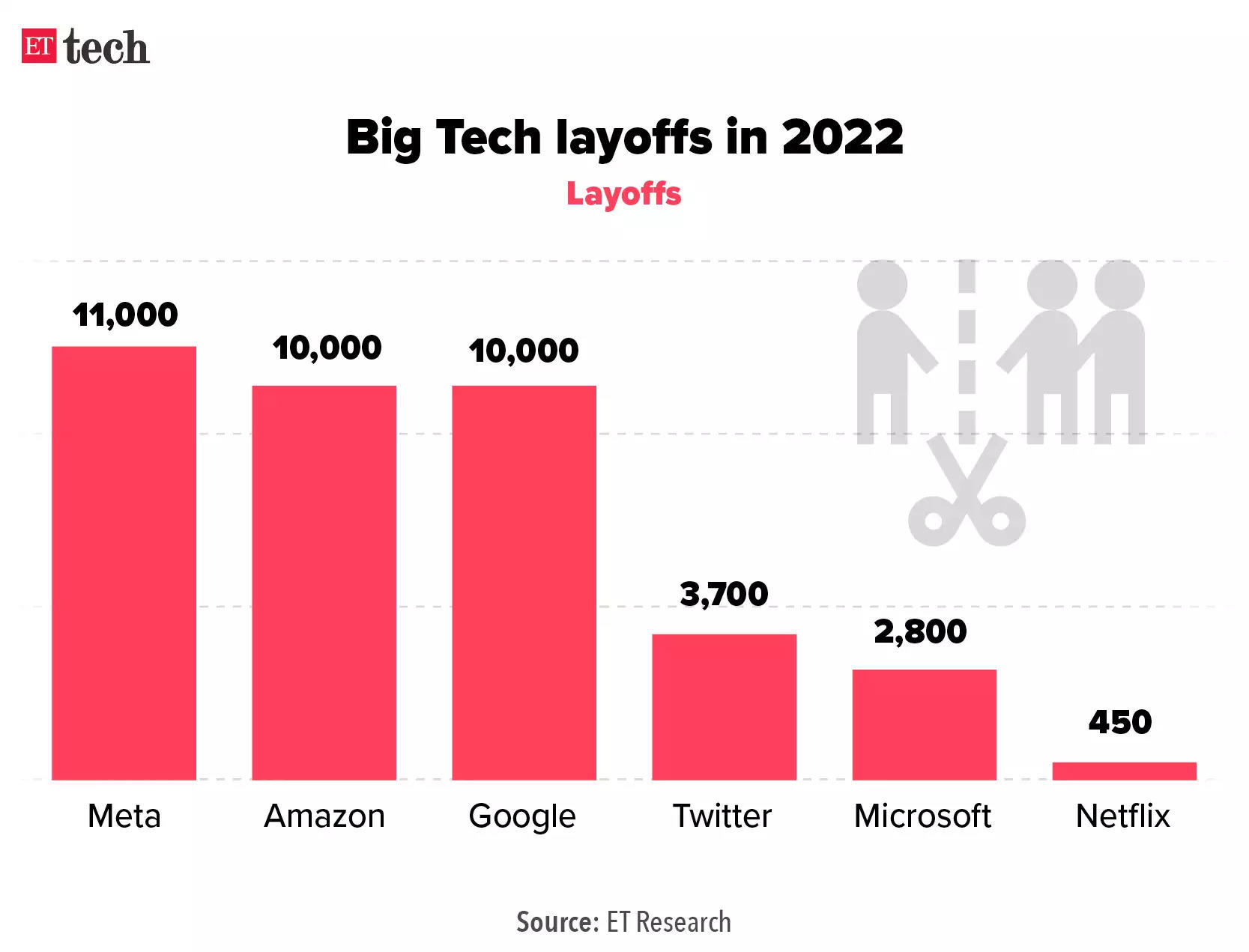

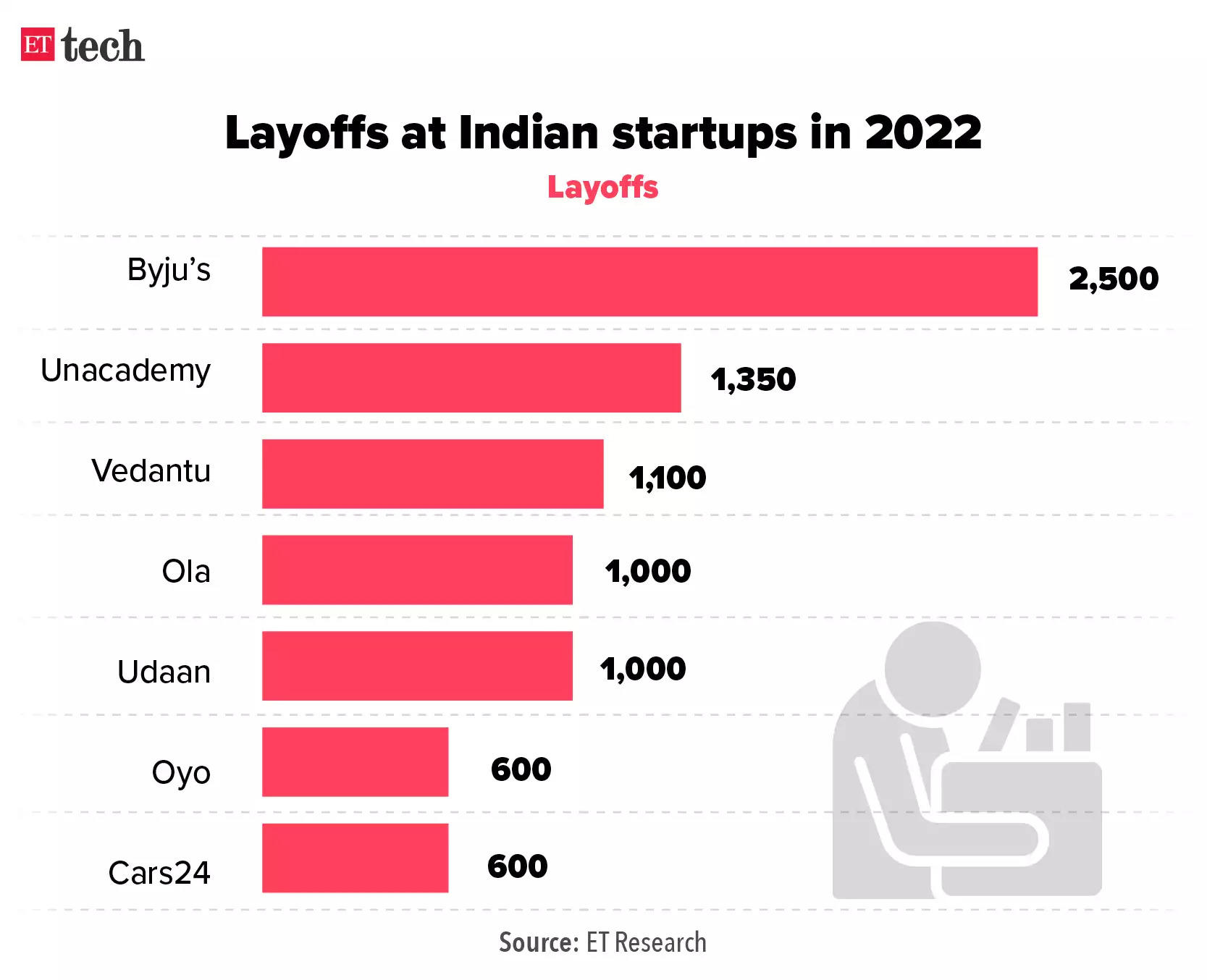

Tech companies embrace layoffs as recession fears mount: Geopolitical instability in Europe, caused by Russia’s invasion of Ukraine, had drastic effects on the global economy after the pandemic.

After two years of staggering growth during the pandemic, online businesses were caught out as Covid began to fade. The Russian invasion was the last straw. Suddenly, tech companies found themselves overstaffed and continued to lay off for the rest of the year.

In other news

Former WhatsApp India chief Pai looks set to join Tata Digital: Vinay Choleti, the former head of WhatsApp Pay in India, who left Metta within four months of taking the role, is in advanced talks to join Tata Digital in its payments business, multiple sources familiar with the discussions said. Choleti spent just over a year at WhatsApp, where he was head of merchant payments before being named head of WhatsApp Pay.

Next financial crisis will come from cryptocurrencies, says RBI governor: According to Reserve Bank of India (RBI) Governor Shaktikanta Das, the next financial crisis will happen because of private cryptocurrencies. He said he still maintains that cryptocurrencies should be banned because they have no fundamental value and pose a risk to macroeconomic and financial stability.

[ad_2]

Source link